Tokenized real estate is transforming the landscape of property investment, combining traditional real estate assets with the innovation of blockchain technology. This convergence enhances liquidity, democratizes access to real estate investments, and fosters transparency in transactions. The concept refers to the representation of real-world properties as digital tokens on a blockchain, allowing for fractional ownership and easier transferability of assets. For more insights into this development, visit tokenized real estate metadefiassets.com.

Understanding Tokenization

Tokenization involves the division of tangible assets—like real estate—into smaller, tradable units represented by digital tokens. Each token represents a specific share of ownership in the underlying asset, allowing investors to buy fractions of properties instead of whole units. This innovation opens the door to a more extensive range of investors, including those who might not have had the means to invest in traditional real estate due to high entry costs.

The Benefits of Tokenized Real Estate

1. Increased Liquidity: One of the most significant advantages of tokenized real estate is the liquidity it offers. Traditionally, real estate investments are illiquid, with investors needing to wait for long periods to see returns or cash out. However, with tokenization, properties can be bought and sold more quickly on secondary marketplaces, enabling faster turnaround times for investors.

2. Accessibility: Tokenization lowers the financial barriers to entry for real estate investment. Investors can purchase tokens representing a fraction of a property, reducing the capital required to enter the market. This democratizes real estate investment and allows a broader demographic to participate.

3. Transparency and Security: Blockchain technology, the backbone of tokenization, ensures that all transactions are secure and transparent. Each transaction is recorded on a public ledger, making it easily verifiable and reducing the risk of fraud. This level of transparency builds trust among investors, simplifying the due diligence process.

How Tokenization Works

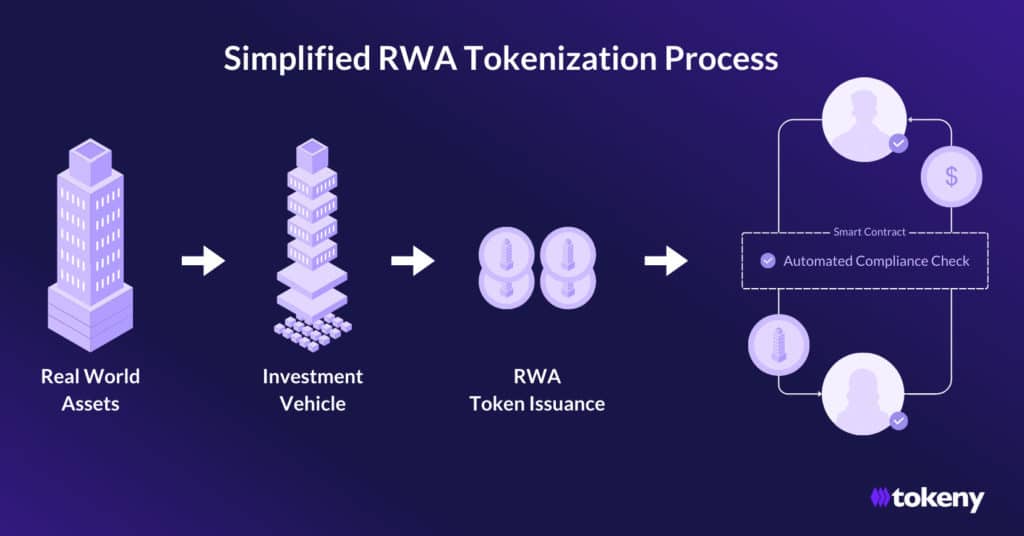

The tokenization process typically involves several key steps:

- Asset Identification: The first step is identifying a property or group of properties to be tokenized. This includes evaluating the asset’s value, potential for return, and legal considerations.

- Creating Tokens: Once the asset is selected, it is digitized by creating tokens that represent fractional ownership. These tokens are usually ERC-20 tokens on the Ethereum blockchain, enabling easy trading and transfer.

- Listing on Platforms: After token creation, the tokens are listed on a marketplace or platform for sale. Investors can then purchase these tokens, thus becoming fractional owners of the real estate asset.

- Governance and Management: Token holders often have rights to dividends from rental income and decisions regarding property management. This governance structure varies by platform but adds an element of engagement for investors.

Real-World Applications of Tokenized Real Estate

Several platforms and startups have spearheaded the tokenization movement in real estate:

- Real Estate Investment Trusts (REITs): Tokenized REITs allow investors to buy shares in real estate portfolios through tokens, making diversified property investment more accessible.

- Luxury Properties: High-end properties are being tokenized to attract a wider range of investors. By breaking down the cost of luxury real estate, more individuals can participate in exclusive investment opportunities.

- Commercial Real Estate: Tokenization is particularly advantageous for commercial real estate, which often requires significant investment. By allowing fractional ownership, more investors can access this lucrative segment of real estate.

Challenges in Tokenized Real Estate

Despite its potential, tokenized real estate faces several challenges. Regulatory issues remain a significant barrier; different jurisdictions have varying laws regarding securities, making compliance complex. Additionally, there’s a lack of understanding and awareness about tokenization among traditional investors, which may hinder widespread adoption.

Moreover, while blockchain offers increased security, it is not entirely immune to risks, including cyberattacks and potential vulnerabilities in smart contracts used to manage and govern the tokens.

The Future of Tokenized Real Estate

As awareness grows and technology continues to evolve, tokenized real estate is likely to become a more prominent component of the overall investment landscape. The potential for greater liquidity, accessibility, and transparency could lead to increased adoption among investors and developers alike.

Future developments may also include more sophisticated platforms that streamline the tokenization process, regulatory frameworks that support innovation while ensuring investor protection, and broader acceptance of tokenized assets across various markets.

Conclusion

Tokenized real estate is poised to redefine how individuals and institutions approach property investment. By harnessing the power of blockchain technology, the industry can offer a more liquid, accessible, and transparent investment landscape. As the market matures, participants must navigate the accompanying challenges while embracing the opportunities that come with this innovative approach to real estate investing.